CMA Comparison

CMA Comparison

It is with great pleasure that we announce the addition of SelfWealth to our panel of trading providers.

We are proud to offer you the pick of 3 platforms for share trading:

- Macquarie

- SelfWealth

- CommSec

We have prepared this comparison for your convenience and hope that it will aid you in making your decision.

Trade from

$19.95

$9.50

$19.95

Markets

Managed Funds & ASX

Managed Funds, ASX, International

ASX & International

Device

Browser based

Browser & Mobile App

Browser & Mobile App

Research Papers

Provided by Morningstar

Provided by Refinitiv

Provided by Aegis

Settlement Account

Macquarie CMA

ANZ CMA

(Macquarie CMA will be the cash hub)

Macquarie CMA

This table contains information about our broker partners to help you determine the provider you would like to use in respect of share and investment trading undertaken by your SMSF. This table does not contain a complete summary of all the information you may require before making a decision and we encourage you to consider the T&Cs that apply to the relevant platform. This table only contains factual information and does not constitute a recommendation on whether any broker platform is appropriate in light of your circumstances.

What's Next?

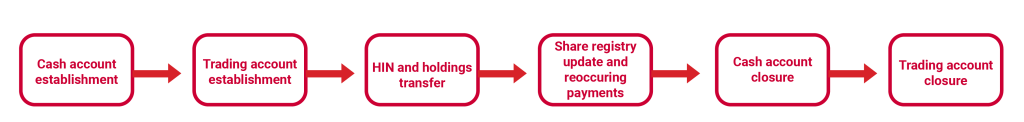

Once you have made your selection, we will get started on the below:

Frequently Asked Questions

Due to changes with CommSec Adviser Services they are no longer a subsidiary of CBA and as a result have rebranded to Ausiex. During these changes Ausiex have announced that the arrangements Xpress Super has held with CommSec Adviser Services since our establishment in 2013 will be cancelled. Beyond cancelling our adviser services, Ausiex are discontinuing the Accelerator Cash Account product. Existing Accelerator Cash Accounts will remain active for client’s to continue using, however no new accounts can be established. From March 2022, the Accelerator Cash Account will no longer have an active data feed into external platforms like our accounting software Class Super, and we will lose our view-only adviser login which has been critical to providing our low-cost service.

To ensure that Xpress Super can still provide the same great service to our clients, we have pivoted and adjusted our services to integrate with the Macquarie Cash Management Account. At the same time, we have also finalised the addition of a new trading account provider to our line-up and are proud to therefore introduce SelfWealth as a trading account provider. Due to the changes to the Accelerator Cash Account, Xpress Super will no longer be offering CommSec as a share trading platform to new clients. We will grandfather this account for existing clients who already hold the account however moving forwards, Xpress Super clients can enjoy share trading via either Macquarie Online Trading or SelfWealth. Xpress Super will aid clients in changing trading account providers, if they so choose, at the same time as implementing the cash account changes to minimise any ongoing or repeated disruption.

To allow sufficient time for transactions (like dividends and contributions) to be redirected to the new bank account, the existing CBA Accelerator Cash Account will not be closed by Xpress Super until 1 February 2022. At this time, we will send CBA the signed account closure form to close the cash account, and transfer any residual balances over to the new Macquarie CMA. We hope that this provides you sufficient time to update the cash account details where required for all income and expenses as required.

As of March 2022, Xpress Super will no longer have the ability to view accounts or receive data feeds for the CBA Accelerator Cash Account. For this reason we cannot continue to support these accounts in future. Where you wish to utilise an account that is not the Macquarie CMA, it is required to have an available data feed into Class Super, and will incur an additional $200 annual fee each financial year. We will grandfather the CommSec share trading account for those who wish to retain this, therefore no additional fee will be incurred if you opt to remain with CommSec.

When you return your signed documents to us, the establishment and transition is expected to occur within 10 business days. If we are arranging a HIN transfer, this may take a little longer.

Yes. Xpress Super have designed the establishment and transition process to remove as much paperwork as we can from you. You are still required to print and sign some documents, however we clearly identify this with you to make it as easy as possible and remove any confusion.

We are unable to advise you on this decision as it is in the realm of providing financial advice. Under our scope of services we can provide you the information of each platform so that you can make an informed decision. To start, we recommend you view our comparison page here which covers the basics of each platform and highlights some key differences. For specific product information, you may also wish to contact the providers directly, otherwise our team are able to guide you with any further comparative questions.

As the ANZ cash account is a specific settlement account maintained within your SelfWealth login, you do not have full access to or functionality within the ANZ cash account. Therefore it is unable to receive dividends, employer contributions or make certain payment types such as BPay transactions. In addition to this, the ANZ account is not accessible by the usual online access provided by ANZ, it is purely visible through your SelfWealth login.

The Macquarie CMA can only act as a settlement account for the CommSec and Macquarie Online Trading share platforms. Due to SelfWealth’s arrangement as a fixed-fee broker, their trades can only be settled to a specific ANZ cash account which is maintained within your SelfWealth login. Via your SelfWealth login you have access to deposit and withdraw funds between the ANZ cash account and your Macquarie CMA. SelfWealth have recently released instant deposits into the ANZ cash account to enhance this service.

Yes, we are happy for you to provide us a copy of ID for each member via email or our upload facility, instead of within the authority form. Please note that the authority form does require a file to be uploaded, and therefore you may wish to consider uploading a non-confidential, or blank document such as a screenshot for the purposes of satisfying the form submission. Any such attachments will not be retained on our systems as we will override them with the ID you have provided directly to us.

The transition pack documents must be signed by wet ink signature, that is a pen to paper signature. Electronic signatures are not acceptable for these forms. While a wet ink signature is required, Xpress Super can accept electronic copies to be returned to us. We therefore urge you to print, sign and scan back the signing pages of each document. While we can accept these documents via post, we recommend and prefer electronic communications to ensure the speed and delivery of signed documents.

There are no establishment or ongoing fees to utilise the Macquarie CMA, Macquarie Online Trading or SelfWealth accounts. Xpress Super have chosen these providers as they align to our efficient and low-cost focus. Further to this, Xpress Super will be providing establishment and transition services at no charge as we recognise the cash account changes have been borne from CommSec Adviser Service’s actions, and is not a result of your, or Xpress Super’s actions.

This is a significant project for Xpress Super as it impacts the majority of our clients, so we do ask that you complete the form and finalise any subsequent action as soon as possible. Important factors to keep in mind may include the holiday season which may naturally cause delays due to business closures and your own personal commitments, and the cut-off date for adviser access set by CBA is March 2022. By this time the Accelerator Cash Account should be closed and any residual balances transferred to the new Macquarie CMA to avoid complications during the process. In this unique and time-sensitive situation, management are happy to share with you our own internal guidelines for your

reference:

- 13 December 2021 Authority forms submitted to Xpress Super

- 20 December 2021 Signed documents returned

- 11 January 2022 New cash and trading accounts open and active

- 1 February 2022 Close CBA Accelerator Cash Account and CommSec share trading

- March 2022 CBA Accelerator Cash Account data feeds to cease

If you have any questions in relation to this please contact us at administration@xpresssuper.com.au.

Looking to Establish an SMSF or Transfer an existing SMSF?

Talk to one of our experts, we’re here to help!

We are open: Monday - Friday 8:30 AM - 5:00 PM (ACDT)

Sydney

Level 13, 333 George Street

Sydney NSW 2000

Melbourne

Level 20, 15 William Street

Melbourne VIC 3000

Adelaide

65 Gilbert Street

Adelaide SA 5000